Vermeer Investment Management

About the Fund

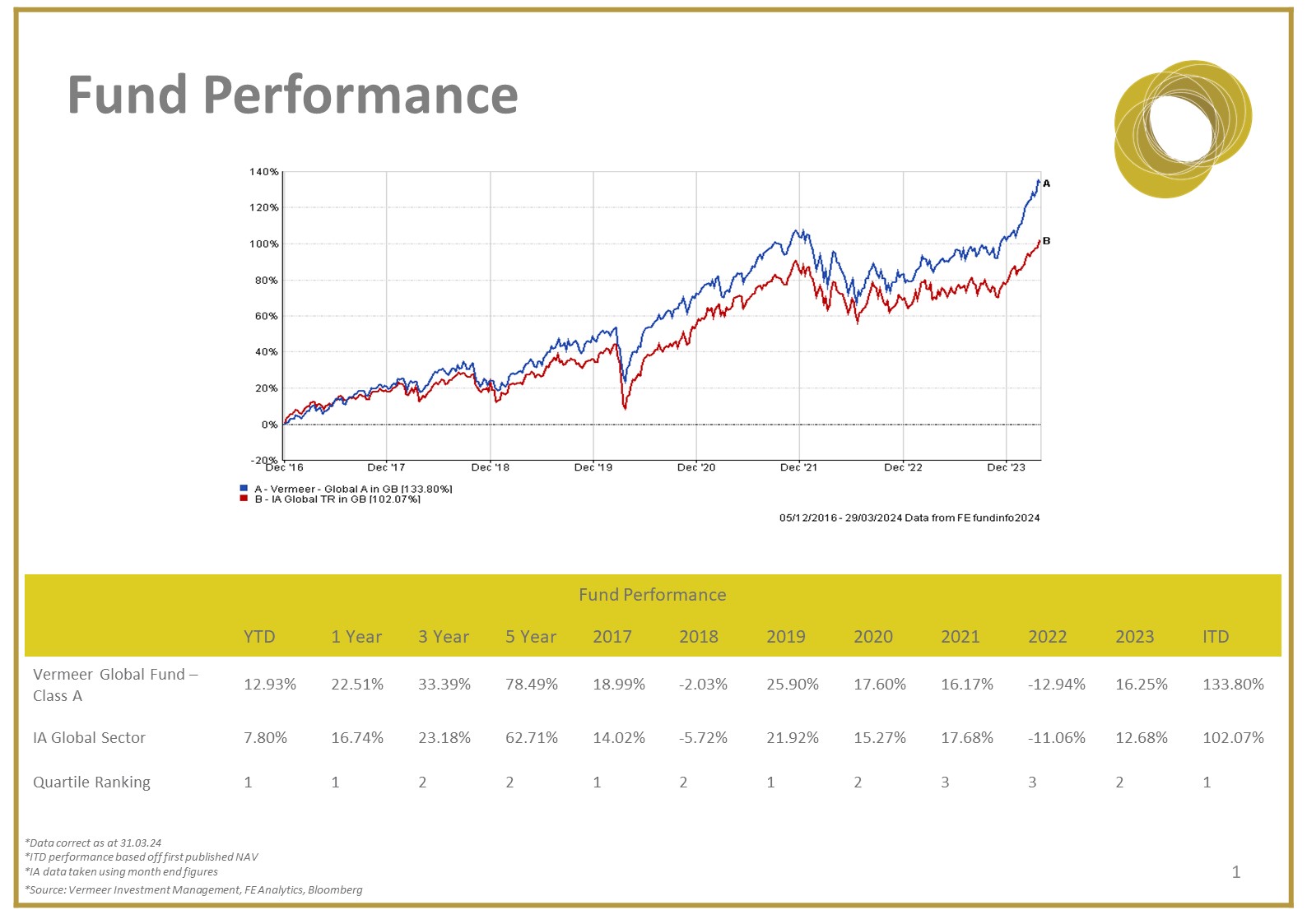

Vermeer was founded in 2014 with its first Fund, the Vermeer Global Fund, launched in December 2016. The Vermeer Global Fund has a proven track record of consistent outperformance with an investment team with over 60 years of combined market experience and interests that are completely aligned with investors as the team all have significant investments in the Fund.

The objective of the Vermeer Global Fund is to generate long term capital growth. The Fund will seek to achieve its objective by investing primarily in a diversified portfolio of global equities that have attractive growth potential. There can be no guarantee that the Fund’s objectives will be achieved.

The Vermeer Global Fund can invest in between 30 and 60 individual stocks. The Fund is benchmark, geography and style agnostic with a high active share and invests in a highly liquid portfolio of listed equities across a wide range of market capitalisations. Since launch, the Fund has always been at the upper end of this holdings range.

In pursuing its objectives, the Fund seeks out opportunities that in its opinion offer the best possibility of capital and dividend growth, provided the securities satisfy the investment process. The Fund aims to identify companies that it believes will offer the prospect of capital appreciation and takes a long-term approach to selecting investments. The managers of the Fund have a large proportion of their own liquid wealth in the Fund and so the team’s interests are highly aligned with investors.

UCITS ICAV

The Vermeer Global Fund is recognised by the FCA and regulated by the Central Bank of Ireland and is a sub fund of the Irish domiciled Vermeer UCITS ICAV. The Vermeer UCITS ICAV is a non-PFIC and is registered as a foreign partnership.

Investment Objective

The aim of the fund is to generate long term capital growth. The

fund invests in a diversified portfolio of global equities that have

an attractive growth potential. The portfolio will hold between 30 and 60 stocks.

Top 10 Stock Holdings

Stock

Weight

Portfolio Manager

Tim Gregory

Available Platforms:

7IM, AllFunds, Ascentric, Aviva for Advisors, Embark, FNZ,

Hargreaves Lansdown, Novia, Pershing, Platform Securities,

Raymond James, RBC, Rensburg, Succession, Transact,

Fidelity, AJ Bell

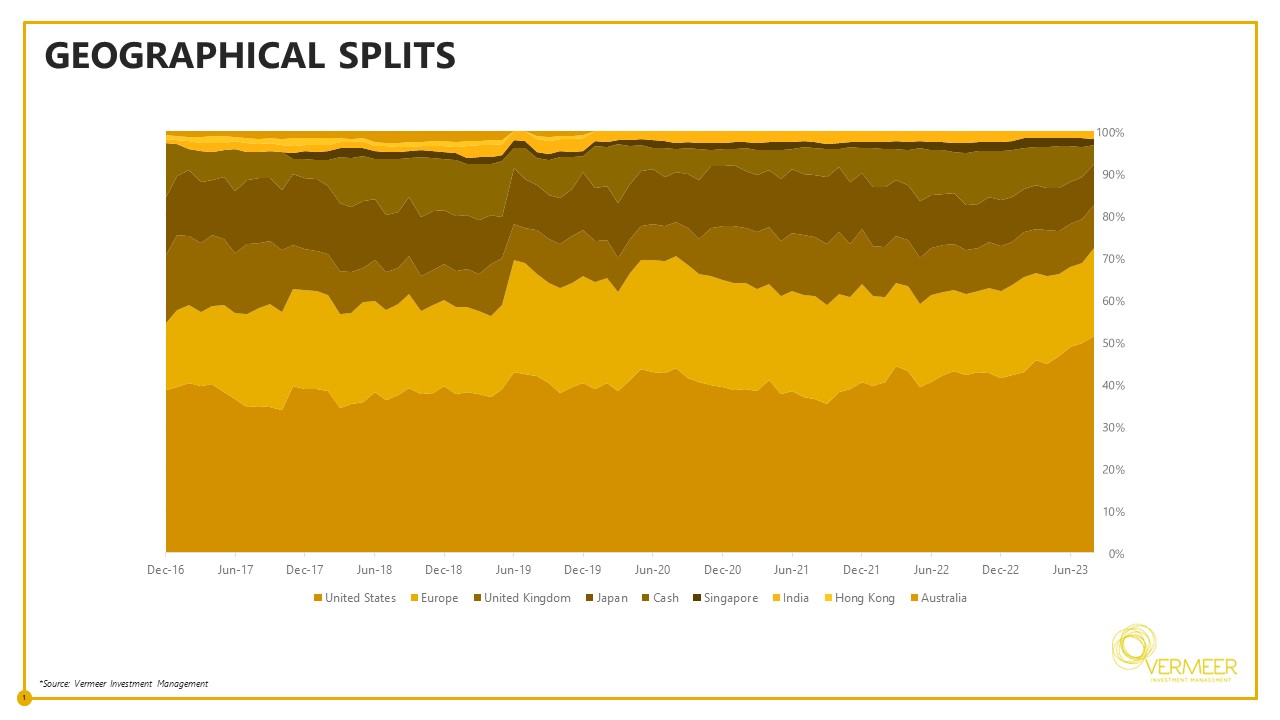

Geographical Split

United States

55.18%

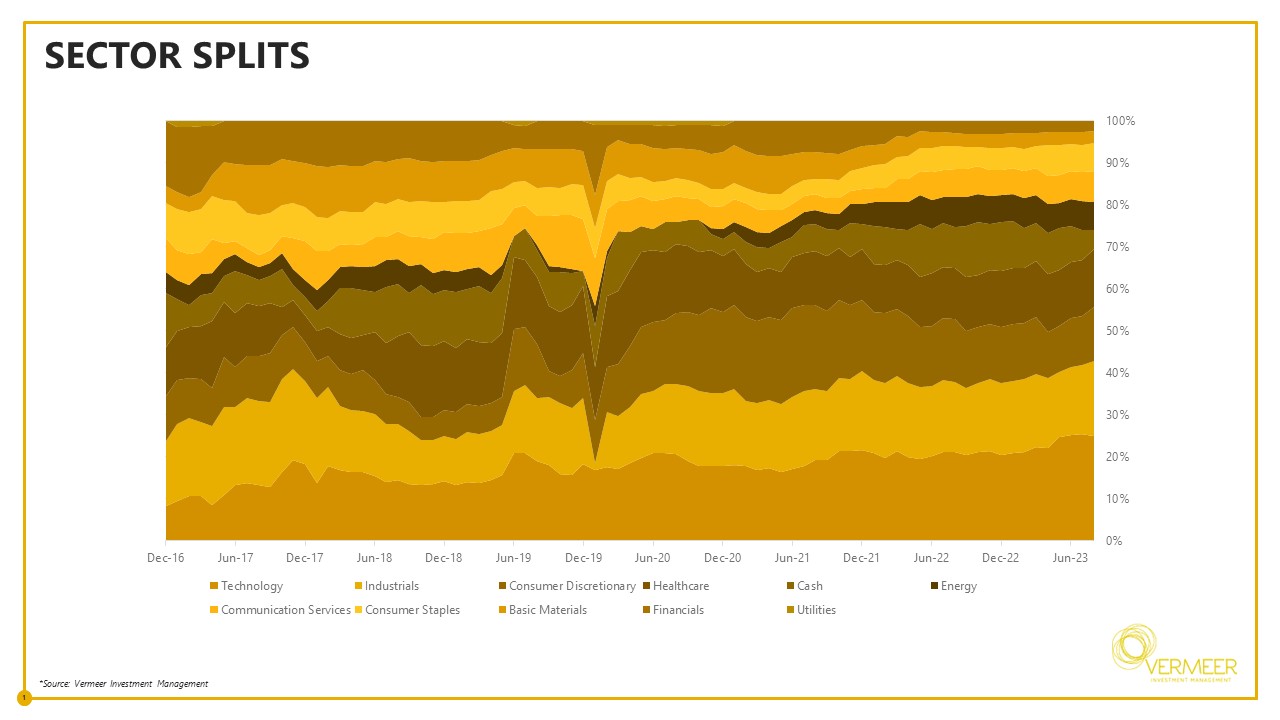

Sectors

Communication Services

9.64%