Funds

Investment Approach of the Vermeer Global Fund

The objective of the Vermeer Global Fund is to generate long term capital growth. The Fund seeks to achieve its objective by investing primarily in a diversified portfolio of global equities that have attractive growth potential. There can be no guarantee that the Fund’s objectives will be achieved.

Why is the Vermeer Investment Approach different?

- Stylistically and geographically agnostic, for example we have historically been significantly underweight US equities

- Focus on Asian economies and exposure to growth in Asia

- Focus on Mid Cap ($10-50bn market cap) investment ideas that are at their early stages of development

- As a small firm, the portfolio managers want to have a close working relationship with our clients.

The Vermeer Global Fund invests in up to 60 individual stocks. The Fund is benchmark, geography and style agnostic with a high active share and invests in a highly liquid portfolio of listed equities across a wide range of market capitalisations.

Portfolio Construction

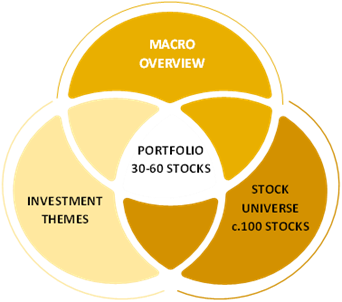

The diagram highlights our investment process regarding portfolio construction, with universe and portfolio holdings numbers related to the Vermeer Global Fund. We start by assessing the global macro environment, which leads to the identification of some long-term investment themes based on our analysis, with companies then selected for inclusion in the portfolio.

Assessing the Macro Environment

As part of our process, we draw internally from the team’s combined experience as well as wide ranging external independent sources of information to help inform our view of the world. We analyse wide ranging economic data across many countries and industries and liaise with our global advisors, including regular contact with economists in the US who have close links and direct insight on the Federal Reserve. Given the global influence of the USA, we spend a considerable amount of time talking to Washington Policy teams from several of our brokers, providing invaluable insight into fiscal, monetary, health and defence policy.

The output from these detailed conversations is debated internally and then often frames our investment decisions and can lead to tactical portfolio changes, such as holding above normal cash weightings in early 2020 at the start of the impact from COVID-19 on markets.

As detailed below, long term themes within the Fund include Europe, Asia, and the UK. We speak to strategists in these areas to gain views into market dynamics and outlook and have formed strong relationships with our brokers in Asia, including Japan, which has been a key investment theme for the Fund since launch. These contacts provide on the ground research which provides an extra level of insight into geographies that are key to some of our long-term investment themes.

Stock Selection

There is healthy competition for capital within the Vermeer Global Fund, so analysing companies before inclusion can be a lengthy and patient process. When selecting stocks, each position is chosen on its specific investment case, although there are certain characteristics that we look for across our holdings, and in the case of the investment mandate, specific focus on outlined requirements. We dedicate considerable time and resource to identifying, tracking and monitoring companies before investing. Background reading, monitoring quarterly reports, valuation metrics and field work are all part of a rigorous process to provide the information needed before initiating a position.

Strong management teams which have consistently delivered over time are a key factor when investing in a company. For example, COVID has really highlighted the quality of management teams in how they have managed their businesses throughout the crisis. In some cases, management change creates both an investment opportunity and sometimes the need to review a position, should a key member of the company leave. We also like companies to primarily invest back in their own business, either via organic or inorganic means and R&D where applicable, and then return excess capital to shareholders first via dividends with buybacks last on the list of uses.

The chart aims to summarise from a high level perspective what we look for when investing in a company.

Vermeer is a strong advocate of sell side research and utilises a wide range of industry contacts to get access to the best research on the street. Drawing on James’s long career on the sell side, we see significant value in sell side research and work closely with analysts on stock selection, helping find new ideas in areas of investment we think are attractive combined with our own analysis. Brokers that we use are listed below but we have coverage ranging from expertise in India and Asia to mid-cap European names and mid-cap US companies.

Whilst we usually use sell side models as a basis for our financial modelling, where necessary we undertake our own bespoke work, especially where we believe there is considerable scope for positive or negative earnings surprises.

Research costs are covered by the business and are not charged to investors.

Engagement with companies and management teams is an important part of our investment process. We aim to meet regularly with the companies held within the portfolio, either directly, at conferences or as part of group meetings and as mentioned earlier, we use conferences as an opportunity to meet with as many companies as possible. This provides a valuable source of information as to the thinking of other firms whilst also sometimes creating new potential investment ideas.

As mentioned earlier, since launch the Vermeer Global Fund owns between 50 and 60 positions, with 60 the hard limit of total portfolio positions that can be owned in the Fund.

Alongside this, we have a watchlist and we monitor these positions as if we own them by meeting companies and management at conferences and monitoring quarterly results. The hard limit of 60 names within the portfolio creates competition for capital and where we feel a position on the watchlist now reflects a better investment opportunity than one of the holdings in the Fund, we will initiate a new position. As an example, Walt Disney was on our watchlist for over two years before we initiated a position in the company.